You can find this write-up in PDF here → bit.ly/RedBeryl_BankOZK

Bank OZK sounds terrible on paper: an Arkansas-based regional bank with a large concentration not only to Commercial Real Estate, but specifically to the higher-risk construction loans. The research analyst at Citigroup covering the stock has not contributed to calm investor’s nerves, raising the alarm on a massive $915m construction loan that, in his view, is at risk of impairment.

However, we believe that these concerns are grossly overstated, and that they provide an attractive entry point to acquire one of the best-run and most differentiated financial institutions in the US. We will dig deeper throughout this write-up, but for now we will just present four facts:

I. In its 27 years as a publicly traded entity, Bank OZK has compounded at 17% p.a., vs 8% p.a. for the S&P 500.

II. Current CEO George Gleason took control of the bank in 1979 when he was 25. He is now 70, working 10 to 12h every day, and has stated his determination to stay for another 10 years.

III. Despite its focus on construction lending, Bank OZK has averaged, during the past 45 years, 63% less loan losses than the average US financial institution. Also, the bank has not lost money in any single year, not even during the GFC.

IV. Its current balance sheet would be able to absorb losses accounting for 22x their current level of non-performing-assets, or 6x the peak level of loan losses experienced during the GFC.

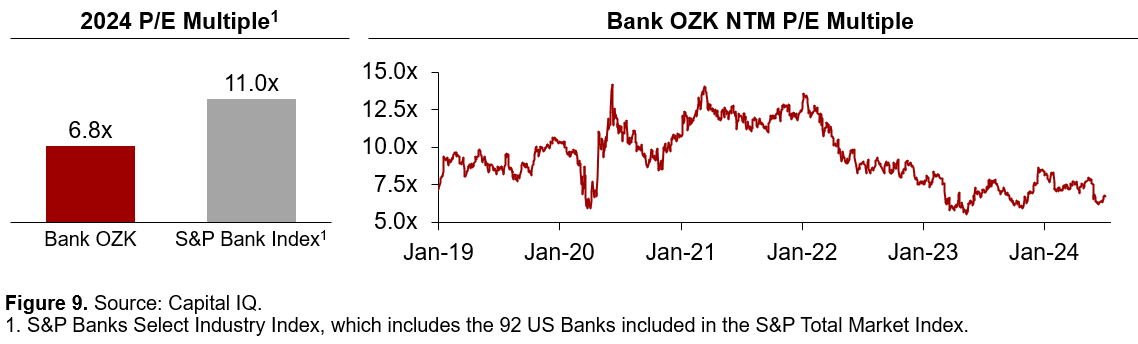

At 1.1x Tangible Book Value and 6.8x 2024 Earnings, we believe Bank OZK is a safe bank to own, and it is likely to outperform the S&P 500 over the coming decade.

Contents

Bank OZK’s fit with Red Beryl’s Investment Strategy

Opportunity Overview

CEO Referencing

Overview of Commercial Real Estate Lending

Bank OZK’s Real Estate Solutions Group

Negative Report from Citigroup

Diversification efforts

Risks

You can find this write-up in PDF here → https://bit.ly/RedBeryl_BankOZK

1. Bank OZK’s fit with Red Beryl’s Investment Strategy

In our first write-up since launching Red Beryl, we covered Nubank, the largest digital bank outside Asia. For all the reasons presented, we think Nubank is a uniquely compelling opportunity, but being based in Brazil and with a $60Bn market cap, it is not a good reflection of what we expect the average Red Beryl investment to look like.

Given we do not have the burden of managing a large amount of capital, we spend most of our time researching smaller companies, often in the low hundreds or even tens of millions in market cap. We believe that fewer eyeballs focusing on this segment are likely to result in a more fertile hunting ground for our efforts.

However, having now been live for 3 months, we must admit that, so far, we have failed miserably at finding such opportunities. We did come across a number of smaller businesses trading at optically low valuations, but in all cases where we spent proper diligence time, we reached the conclusion that the low valuation was warranted, in most cases, due to a lack of moat vs larger players. Perhaps this is the nature of small cap investing after all, but so far we have not managed to gain comfort on any of our ideas. We will keep trying.

Bank OZK is, instead, the product of a different exercise. Given strong negative sentiment on Regional Banks and Commercial Real Estate, we have spent time on the space, trying to find the one high-quality bank whose valuation is irrationally brought down due to industry headlines, as opposed to bottom-up research. With this renewed approach, Bank OZK was not hard to find: it trades as the bank in the S&P Total Market Index with the lowest 2024 P/E valuation. What follows is the result of a diligence exercise that has led us to believe that, contrary to what its valuation might suggest, Bank OZK is one of the best-run banks in the country, with a unique moat, sound lending principles and a healthy loan book.

2. Opportunity Overview

Bank OZK is the modern name for Bank of Ozark, which began as a one-branch community bank in Jasper, Arkansas in 1903. In 1937 it opened a second location in Ozark, Arkansas, and operated as a two-branch community bank until 1979.

In 1979, current CEO George Gleason, back then 25 years old, took control of the two-branch bank, financing it with $10k of his own funds and borrowing $3.6m from a client of the law firm he used to work for. When he took over, Bank of Ozark had 28 employees and $28m in total assets.

The company expanded as a community bank in Arkansas, and in 1997, with 11 branches and $287m in total assets, the company IPOed on Nasdaq. By 2005, having reached 54 branches in Arkansas, Bank of Ozark started an expansion into Texas, opening its first 3 branches in the state, and marking the first step of Bank of Ozark’s regional expansion. Recently rebranded as Bank OZK, the company today has $34Bn in total assets, making it the 55th largest bank in the USA. Its market cap is $4.7Bn.

On the deposit side, Bank OZK is not particularly differentiated. It operates as one more of the multiple regional banks in the US, raising deposits from a network of 228 retail branches in the Southeast. Its cost of funds is in line with industry average: if anything, given Bank OZK’s above-average rate of growth, it oftens needs to offer slightly higher remuneration than average to attract new deposits with which to fund the increase in outstanding loans.

Instead, where Bank OZK differentiates is on the asset side, using those deposits to fund four different lending operations, the largest of which is unique across the US:

I. The Real Estate Solutions Groups (RESG) is the bank’s crown jewel. It accounts for 65% of the loan book, and it is a highly sophisticated nationwide operation focusing on construction loans of very large and highly complex commercial real estate projects. It has best-in-class return on assets, and has performed with a very low level of loan losses throughout its history due to (i) funding well-capitalized developers with very strong track records (ii) engaging only in high-quality Real Estate projects that Bank OZK thoroughly diligences and (iii) offering very low loan-to-value ratios of around 40%. We will deep-dive into this unit later in this report.

II. The RV and Marine segment offers, through a network of specialized dealers, loans to high-net-worth individuals for the purchase of different types of recreational vehicles, such as boats, campervans and motorhomes. They focus primarily on customers that have already owned two or more RVs in the past, so that they understand the financial burden it represents.

III. The Community Banking segment offers primarily loans to small and middle-market businesses in the states where Bank OZK has a physical presence.

IV. The Corporate segment offers primarily Asset Backed Loans (ABLs, secured by either Inventory or Accounts Receivable) and Equipment Finance loans to large corporations nationwide.

The Real Estate Solutions Group (primarily) and the RV and Marine division (to a lower extent) are unique and differentiated, with higher barriers to entry than most other banking products. The Community Bank and Corporate segments, on the other hand, are much more commoditized and not differentiated from what other regional banks regularly offer.

Given Bank OZK’s outsized exposure to construction loans, which are usually considered riskier, it will likely come to no surprise to the reader that Bank OZK obtains a higher average interest rate on its loan book than the average US financial institution. This spread has averaged 110bps over L20Y.

However, despite Bank OZK’s loan book commanding higher yields and apparently entailing more risk, the company has an exceptional track record of credit quality. When comparing loan losses across its entire loan book, the company has outperformed the average of all other banks in the US in every single year since IPO, averaging 63% less loan charge-offs than the industry.

The result of being able to offer loans with higher yields and fewer losses than the industry, combined with an adequate control of the cost base, results in Bank OZK having a much higher return on assets and much lower cost-to-income ratio than the industry, pointing to a high-quality banking operation.

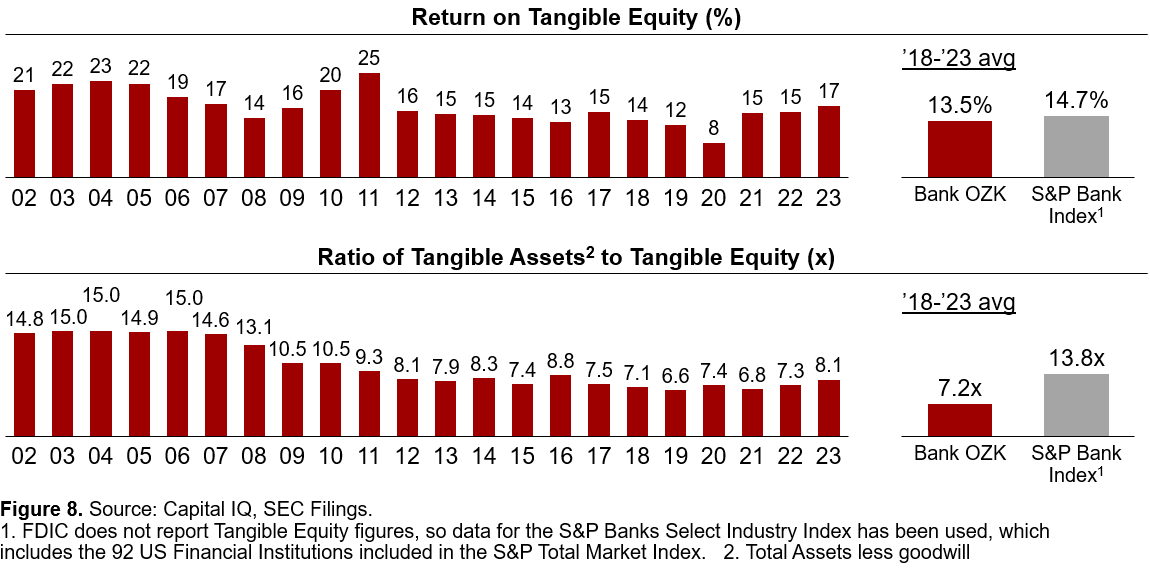

Given the preceding discussion, the reader is likely to have assumed that the Return on Tangible Equity of Bank OZK would be best-in-class. And indeed, between 2002 and 2011 it far outstripped that of the average US banking industry, averaging ~20% RoTE in the decade that included the GFC.

However, in the last 10 years, RoTE has been meaningfully lower, averaging only 14%, even if Return on Tangible Assets has been roughly constant through the cycle (Figure 6). The explanation to the falling RoTE can be found on a steep reduction on the leverage ratio of the bank (how much assets a dollar of equity supports). As can been seen in Figure 8, pre-GFC the bank held 15x as many Assets as it held Equity, with the ratio falling to 7x for the L5Y.

The reason for the strong deleveraging of the bank is primarily attributable to regulation:

I. The Basel II and Basel III accords generally increased the capital requirements for banks.

II. Bank OZK has evolved into a model whereby the construction loans it offers are drawn progressively as the construction evolves. This provides additional safety for the bank, given strict covenants around completing the successive construction phases on-time and according to budget to unlock the next loan tranche. However, for regulatory purposes, having those undrawn commitments results in an increase in risk-weighted assets and therefore the requirement to hold additional capital, even if the undrawn portion of the loan does not provide interest income.

As per Figure 6, Bank OZK has about twice the Return on Asset as the average US Bank. However, as per Figure 8, it has roughly half the leverage ratio. As a result, the RoTE comes in at a roughly similar level as all other US Banks (120 bps lower for the L6Y, to be precise).

We believe that the current regulatory framework over-penalizes Bank OZK for having large undrawn commitments, which are a unique characteristic of its business model. As discussed in Section 5, this practice de-risks the loan book, as further evidenced by having 63% fewer charge-offs than the industry for the L20Y (Figure 6).

However, shareholder returns are seldomly affected by fairness considerations, and there is no doubt that a lower RoTE translates into softer long-term performance. There are only 2 partial mitigants:

I. Bank OZK has historically distributed ~50% of the earnings as either dividends or share buy-backs, and therefore the lower RoTE applies only to the undistributed portion of the earnings.

II. In the years 2018, 2019 and 2021 market participants took, in the CEO’s view, excessive risk when it comes to CRE loans. Hence, Bank OZK pulled back, reducing leverage and origination volume to avoid taking undue risk. The leverage ratio on those years fell to as low as 6.5x. The excessive risk-taking translated into the CRE crisis the US is now experiencing.

The ongoing stress in CRE loans has resulted in reduced competition since 2022, leading to more attractive loan terms and Bank OZK increasing originations and leverage (above 8x today). As a result, in the near future, RoTE will likely be stronger than it has been in L6Y (17% in 2023 vs 13.5% in L6Y). In the long-term however, periods of excessive risk taking and, hence, lower opportunities for Bank OZK will almost certainly re-occur.

All things considered, our investment thesis, which we will attempt to prove over the coming sections, is the following:

I. Bank OZK is a safe bank to own, despite its concentration in commercial construction loans, given (i) lower leverage and two-thirds fewer loan losses than the average banking institution, (ii) the specific type of construction loans it offers, (iii) a bright owner-CEO that has a 45 year track record and that intends to stay in the business for another 10 years and (iv) no interest rate risk and (v) a deposit base with a very high insurance ratio.

Also, note that its current balance sheet would be able to absorb losses accounting for 22x their current level of non-performing-assets, or 6x the peak level of loan losses experienced during the GFC (Figure 23).

II. Through the cycle, Bank OZK will continue to earn an average of ~13-15% RoTE, which, combined with a current valuation of 1.1x TBV, yields a base return of the same magnitude.

As discussed in Section 5, in our view, Bank OZK has a strong moat and engages in a far more differentiated activity than most other banks. This does not lead to better RoTE than industry average due to regulatory capital constraints, but it does provide us with a higher level of comfort that Bank OZK “deserves” to earn that RoTE and will be able to defend it in the future, which supports point (II) of our investment thesis above.

III. The valuation is currently depressed due to the ensuing CRE crisis and a highly negative (and unwarranted) recent equity research report from Citigroup. A re-rating to close the valuation gap to either historical levels or the peer group provides a source of upside. For example, an undemanding increase from 6.8x to 9x Earnings in 5 years would boost shareholder returns from 13-15% to ~20%.

With the S&P500 trading at 23x 2024 Earnings and a L20Y revenue-per-share CAGR of 5% p.a., if point (I) above is true, we believe Bank OZK is likely to outperform the index in the long-term.

3. CEO Referencing

Banking is a highly execution-driven business, where poor management can introduce an undue amount of risk. This is especially true in the case of Bank OZK, given its concentration towards construction commercial real estate. We draw great comfort from the fact that current CEO George Gleason has the demonstrable track-record outlined in Section 2, which he started at the very young age of 25:

“I arrived at the bank the morning after closing the transaction. I had called a meeting for my new staff at 7:30, to introduce myself and meet them and, and I gave them a little speech. […] Afterwards, I went to my office and I was thinking, gosh, I wonder what the Chairman CEO of a bank does at 8:30 on the morning?” – George Gleason, Bank OZK CEO

We have not been able to meet George Gleason directly, but we have referenced him through other stakeholders. He refers as a highly bright individual:

“George was the most intelligent human that I have encountered in my career, he is absolutely unbelievable. Photographic memory, incredibly intelligent […]. George worked harder than anyone at the bank and was more driven than anyone at the bank. That culture migrated its way down to the lower levels, it was a culture of performance.” – Former Chief Credit Officer, Bank OZK

“Attending a meeting with George was intimidating. You knew that even if you had spent hours preparing, he was going to ask the one relevant question you had not thought about.” – Former SVP of Construction Lending, Bank OZK

“Long ago when I was on the sell-side, not long after the financial crisis I spent a day with Bank OZK’s CEO George Gleason meeting clients. To this day he remains among the most impressive managers I have met. In listening to perhaps 200 questions asked of him all day he was different in how he tackled problems and opportunities. Gleason is detail oriented, holds a higher standard than most bankers, and he thinks. I recall when he described his 45% efficiency ratio (a top quartile number) as “terrible” in a call years ago. Most bankers would not have the proper idea of where the components of the efficiency ratio should be to form that opinion, much less be willing to describe that level as bad.” – Sam Haskell, former Research Analyst

George owns ~5% of Bank OZK, a stake worth ~$250m. He has had a number of liquidity events, but his stake in Bank OZK is likely to still constitute a large percentage of his net worth (he owns roughly the same number of shares as he did back in 2005). He has invariably acted in a highly shareholder-friendly manner. For example:

I. The bank has been highly rational about capital issuance and share repurchases. Between 2012 and 2018, with the bank trading at north of 3x TBV, they issued a large amount of capital to grow and acquire distressed banks in highly accretive transactions. On the other hand, in L3Y, with the bank trading at depressed valuations, they have implemented frequent buy-back programs (retired 13% of outstanding shares since 2021).

II. As discussed in Section 2, the bank de-levered in periods of excessive risk taking (prior to Covid and in 2021) and leaned in during periods of uncertainty (Covid and after Ukraine war).

III. The level of disclosure is incredibly granular and one of the best across all US Banks, as highlighted by the large amount of data the reader will find in Section 5.

George is currently 70 years old, but he has no intention to retire. He has publicly stated his goal to stay with the bank for at least another 10 years, and our conversations with insiders seem to confirm it:

“The bank is his number one priority. He loves it, he lives it. I told people as a joke, the worst day for George is a bank holiday because he can't work. And he just loves it. It's his baby. It rules his life. As he's gotten older, what I saw him do is make sure he eats incredibly healthy. He works out all the time. He's got a full gym in his house. He is regularly going to doctor appointments. So he's trying to look at it and say, really and truly, I love it. And I want to do this for another 10 years, until I'm 80 if I can.” – Former Chief Credit Officer, Bank OZK

“George is still working 10-12h every day. There is not a loan above $10m that he does not personally approve. He covers a lot of ground and knows everything that is happening in the bank, and I don’t see it changing anytime soon. He sees the bank as his life project” – Former SVP of Construction Lending, Bank OZK

“I'm trying to advance more and more team members to higher levels so that when I retire in 15, or 20 or 30 years, there is a strong leadership in this company.” – George Gleason, Bank OZK CEO, in a 2022 interview.

Finally, were he to retire, we believe it is unlikely to substantially affect the investment in the first 5-10 years after retirement:

I. George is likely to retain a strong stake in the bank, and therefore ensure the transition to a new leader is smooth. President Brannon Hamblen would be a likely candidate, and he refers well based on our industry conversations:

“Brannon is very hard working and really smart, it is the only way someone can work directly for George. He might not be the most growth-oriented guy, but he is incredibly switched on towards risk. He is extremely conservative, and I think he is very unlikely to do anything dumb with the bank, if he is appointed CEO one day.” – Former SVP of Construction Lending, Bank OZK

II. A new leader will not change the existing loan book overnight, and given average loan duration of 3-5 years, it will take time for newly originated loans to become a majority of the loan book.

III. In the downside case where (I) George becomes incapacitated, (II) a poor manager was appointed and (III) that poor manager changed the origination process overnight, we believe that as investors we would likely realize. As discussed, the level of reporting of the bank is incredibly granular, and an increase in LTV or other poor practice would likely be observed. If the new manager reduced the reporting quality, that would be a very strong red flag and likely compel us to divest.

All things considered, we like the leadership in place at Bank OZK and we believe that for the coming 10-20 years, mismanagement is highly unlikely to occur at Bank OZK.

4. Overview of Commercial Real Estate Lending

4.1. Overview

Before proceeding to deep dive into Bank OZK’s lending activities in Commercial Real Estate (CRE), a general overview of the space is of relevance.

Loans backed by Commercial Real Estate are a wide category that includes basically all real estate that is not single family residential (i.e. houses owned by individuals). There are two main types of CRE-backed lending:

I. Owner-occupied: loans to companies to finance real estate that they need for the normal development of their business activity. For example, an office to accommodate their employees, a factory, a warehouse, or a retail premise to sell their products.

II. Non-owner-occupied: loans to investors that do not use the property themselves, but instead

lease it to a third party and capture rental income.

Owner-occupied CRE-backed loans are considered very safe, given they are usually full-recourse to the borrower. In order for the lender to impair a portion of the loan, the borrower must enter bankruptcy proceedings AND the financed collateral not be enough to repay the loan. This type of loan is not the traditional CRE lending that is usually referred to. They are instead classified as C&I (Commercial and Industrial), and are outside the scope of this report.

CRE lending traditionally refers instead to non-owner-occupied loans. They include all kinds of properties, the most common ones are Multifamily (more than 4 residential units built for rental income), Condos (more than 4 residential units built with the end goal of selling the individual units), Senior Housing (either independent living, assisted living, nursing homes or memory care facilities), Office, Life Sciences (same as office but with Lab space for pharma or biotech companies), Retail, Industrial and Hotels.

Based on the status of the building, there are three types of CRE loans:

I. Construction loans are backed by land and unfinished buildings, as well as guarantees from the developer. They usually carry low loan-to-cost ratios to ensure that the developer has sufficient equity invested in the deal to avoid losses for the lender. They are usually variable rate (e.g. SOFR + 350bps).

II. Bridge loans are backed by buildings that have already been completed but that for some reason have not stabilized yet, i.e. the building is not yet generating cash-flow at its full potential. Bridge loans are used for refurbishment, to fund the period between construction has finished but leasing has not yet occurred, or for acquisition of a property that has a high vacancy rate while the investor attempts to turn it around. Similar to construction loans, they are usually variable rate, and may include guarantees from the developer.

III. Permanent loans refer to the long-term form of financing offered to investors who own buildings that are fully stabilized (i.e. leases are in place) and, therefore, cash generative. They can either be fixed or variable rate (more often than not, they are fixed), and they usually are non-recourse to the investor.

4.2. Permanent Lending

Permanent loans on good quality CRE assets are commonly considered safe, and therefore they conform the majority of CRE loans extended by traditional banks. For example, a 70% LTV loan for a luxury apartment building in Miami that has a vacancy rate of 3% and a Debt Service Coverage ratio of 1.25x is unlikely to lead to loan losses in a normal scenario, given rent is likely to grow over time and a rapid increase in vacancy rate is unlikely, resulting in the developer being able to repay the loan with the rental income without the need of adding additional equity.

There are mainly two ways a lender can lose money on a permanent loan:

I. The rental yield declines because of higher vacancies and lower rents. This can happen either because a specific area loses appeal (e.g. Detroit), an economic change lowers the appetite for a certain form of real estate (e.g. retail buildings with the advance of on-line shopping, or office buildings with the advance of work-from-home) or in the midst of a downturn if some of the lessees default (e.g. tenants become unemployed, office-space renters go out of business, etc.)

II. Interest rates increase and the value of the building falls below the original LTV. Note that the value of a building is computed capitalizing the net rental income of the business with a “cap rate”, which is essentially the inverse of the P/E multiple. For example, a multifamily building generating $1m in net rental income is worth $25m if using a 4% cap rate ($1m divided by 4%), or only $17m if using a 6% cap rate ($1m divided by 6%). If a bank had lent $20m on the basis of a $25m valuation, and the building is now worth $17m, the loan is likely to suffer a loss because the investor has an economic incentive for walking away if either (i) the loan comes due for refinancing or (ii) the loan is variable rate and the rental yield no longer covers debt service.

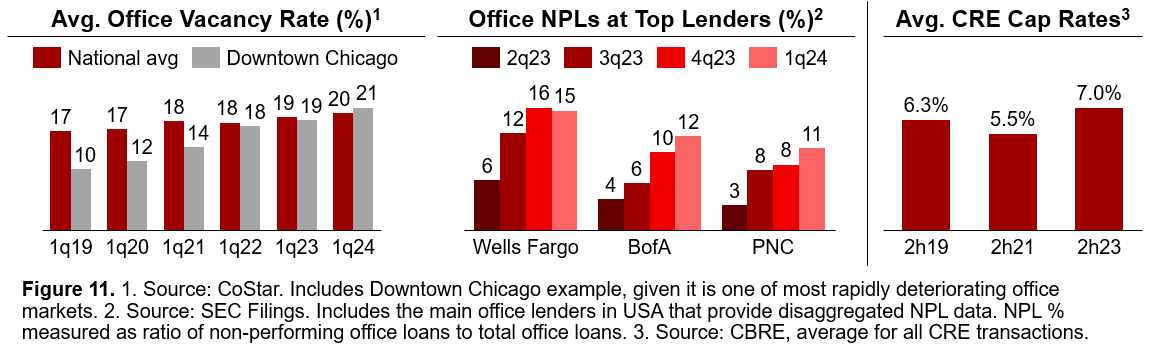

The current scenario is one where the primary sources of distress for CRE permanent lending are materializing in an unusually abrupt fashion:

I. The demand for office changed almost overnight during Covid, with vacancy rates increasing meaningfully and lease prices dropping. Office is a highly prevalent form of CRE (i.e. it is a large market), with some banks having significant exposures.

II. Interest rates increased a lot in a very short period, which has led to stress even in categories where rental yields have not suffered, such as multifamily.

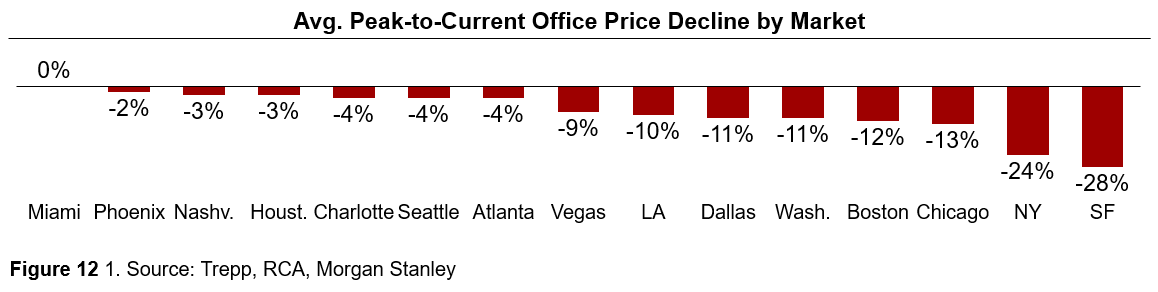

Office is the primary case study for struggling commercial real estate. Average peak-to-current declines reach ~30% in some markets, and in some specific office buildings, much larger declines of up to ~70% of pre-covid value have been observed.

4.3 Construction Lending

Construction loans are usually perceived to be riskier than permanent loans, given the quality of the collateral is lower (an unfinished or pre-stabilization building is harder to monetize upon foreclosure than a finished, stabilized one). Therefore, most banks usually limit their exposure to this type of lending.

The following are the different ways a lender can lose money on a construction loan:

I. Once built, the building generates less rental income than expected. This risk can materialize in all kinds of assets, even apparently safe ones like Multifamily.

“In 2021, many developers decided to build massive apartment blocks in Texas and Florida, betting that lower taxes and the work-from-home trend would lead to large scale migrations away from cities like New York. All of a sudden, you would have three or four massive buildings open next to each other in cities like Houston, and the demand would simply not be there on time.” – Director of Multifamily at Greystone

II. An increase in interest rates increases the cap rate and, therefore, the value of the building once built. This risk, however, is generally lower in construction than in permanent loans, given lower LTVs for the former.

III. There are cost overruns during construction, which leads to the developer not being able to finish the building. Construction loans almost invariably include a completion guarantee from the developer (i.e. the loan is recourse until the building is finished). However, if the developer incurs higher costs than expected across several projects and defaults as an entity, projects might not be completed, and construction lenders could experience losses.

The third point is usually diversified away by having exposure to different developers and projects (i.e. it is unlikely that all the developers a bank lends to will experience cost overruns at the same time). However, in the current scenario, two elements are increasing the risk of widespread cost overruns:

I. Construction lending is almost always variable rate, and therefore developers are experiencing higher interest costs than they had budgeted for.

II. Construction costs are generally experiencing widespread increases due to inflation.

There is no question that we are leaving in a tough environment for CRE. In certain non-cyclical categories (e.g. Life Sciences, Seniors Housing), even more so than during GFC, given in ’08-‘09 interest rates (and therefore cap rates) declined rapidly and alleviated valuation and debt-service-coverage pressures.

5. Bank OZK’s Real Estate Solutions Group

5.1. Overview

The RESG is the crown-jewel of Bank OZK. It represents 65% of the total funded loan book, and it specializes in offering construction loans for very large, Tier-1, “skyline defining” commercial real estate projects. Every loan that they underwrite abides to three core principles:

I. The developer must have a very successful track record with that specific type of project, as well as a strong balance sheet.

II. The project must have very attractive supply-demand characteristics, with positive market trends, similar properties in the same area observing low vacancy rates and limited new capacity coming to market in the foreseeable future.

III. The LTV must be very low, usually not larger than ~40% LTV (i.e. using the forecasted value of the property in the denominator) or ~50% LTC (using the projected cost of construction).

Note that since loans are progressively funded as expenses occur, at any given time only ~50% of the committed amount is outstanding. These leads to significant undrawn commitments that have the effect of requiring significant capital levels at the bank and reducing RoTE. See discussion in Section 2 for more information.

An example of a project Bank OZK lent to in 2022 is a 52-story luxury condo building in 50 West 66th Street, Manhattan. Located right in front of central park, the residential skyscraper was developed by Extell Development, which has successfully developed more than 10 skyscrapers in Manhattan over L15Y. Bank OZK signed a $620m loan for the project, which if fully drawn would be ~50% of the projected cost of the development or ~40% of the total value of the building. However, the actual drawn amount was far lower, given (i) the loan was only drawn progressively as the construction evolved and (ii) Bank OZK had to be repaid first as condos were being sold to final customers before the building was completed. In June 2024, when Bank OZK’s loan was repaid in full, the outstanding amount was only $340m, vs a building value of near $1.5Bn, providing a very large margin of safety for a highly demanded piece of real estate.

Other examples of projects Bank OZK has lent to are:

I. Waldorf Astoria Tower in Miami, which, once completed, will be the tallest building in Florida. It will have 100 stories of Condo and Hotel space. The building is projected to finish construction in 2028, but 90% of the condos are already pre-sold. The building is being developed by PMG, a developer with a portfolio of 150 luxury real estate assets mostly in New York and Miami.

II. Ritz-Carlton Hotel & Residences near Maddison Sq in Manhattan, which will include 250 hotel rooms and 16 residences. The project is being developed by Flag Luxury, a Real Estate investment group with $6Bn AUM and that has developed 6 other Ritz-Carlton-branded assets.

III. Brucker Boulevard Warehouse in the Bronx, a last-mile logistics facility with 106 loading docks and 1.1M sqft internal space. Amazon has already leased half of the available space.

As the reader can appreciate, the examples above are likely to become high quality real estate assets with high expected collateral value in case of default. Together with experienced developers and low LTVs, we believe this practice constitutes a sound form of lending.

“We have several loans with a committed balance above $500m. This is as much as 10-15% of our equity. I understand that other banks might not feel comfortable with this level of exposure, and I understand the reasoning behind diversification. But the reality is that the larger the project, the more experienced and better capitalized the sponsor is, and you can do a transaction like that at a much lower leverage than a $50m transaction, given lower competition. Also, the collateral is likely to be of much higher quality.” – George Gleason, Bank OZK CEO

“Even with the best sponsors, you see them sometimes struggle and make mistakes. This is why it is paramount to have a great asset as ultimate collateral and a very low LTV.” – George Gleason, Bank OZK CEO

“I would love to be able to participate in the permanent financing after construction is complete, but LTVs are too high. If you offer a 70-80% LTV and something goes wrong, you can get into a lot of trouble. Also, I would have to offer fixed rate loans with a tight pricing.” – George Gleason, Bank OZK CEO

5.2. Terms of lending

Based on our research, Bank OZK is highly disciplined in their origination, and does not compromise on the following terms and conditions:

I. Bank OZK is always the most senior member of the capital structure.

II. Loans are short-term, and need to be repaid with a maximum of 3-5 years, in order to limit the impact of longer-term changes in supply/demand.

III. The loan must be variable rate, so that Bank OZK does not incur interest rate risk.

IV. The developer must purchase an interest rate hedge, so that he is protected from an increase in interest rates. This was already in place before rates rose.

V. The developer must provide a completion guarantee (i.e. the loan is full recourse to the developer until it is completed).

VI. The developer must abide by a carefully defined set of construction milestones. If a certain phase of the construction takes longer or is more expensive than expected, the developer is in breach of covenant and must negotiate a cure with Bank OZK, which entails introducing additional equity in the property.

VII. Bank OZK only starts funding the loan once the Developer’s equity is fully invested in the project, i.e. the first ~50% of construction expenses are borne by the developer, and only after that point does Bank OZK start lending to cover future costs. Exceptions to this rule occur exclusively in case a highly capitalized mezz lender (e.g. Blackstone, Brookfield) negotiates to fund its tranche pro-rata with Bank OZK, but even in that case the developer’s funds will have been deployed at inception.

VIII. As discussed, LTVs are rarely above 40% and LTCs above 50%. More importantly, for non-residential projects that may be hard to lease upon completion (e.g. a large office, warehouse or life sciences project) a substantial portion of the funds is earmarked for “good news” funding, i.e. costs incurred once a lessee is found, such as lease commissions or building modifications requested by the incoming tenant. As a result, in such projects, LTC before lessees are found is rarely 50%, but more often in the 30-40% range.

Finally, Bank OZK screens as being on the more expensive end of the spectrum, ensuring that they are appropriately compensated for the risk taken:

I. On average, Bank OZK charges SOFR+350bps and a 1-2% origination fee, significantly more than the rates available on other types of CRE loans.

II. Loans have make-whole provisions that ensure a minimum total interest is paid throughout the life of the loan, protecting the bank from loss of revenue in case of early refinancing or low drawdowns.

III. Loans often have floor rates to protect the bank’s revenues in case interest rates decline. As of 1q24, 56% of the loans had a floor at SOFR=225bps or above (i.e. minimum interest of ~5.75% assuming 350 bps spread). The figure is currently trending upwards as old loans get repaid and new loans, originated in a higher-rates environment, have higher floors.

5.3. Key selling points

As described above, Bank OZK has far more restrictive loan terms than other banks. In order to close a deal, Bank OZK’s main selling points are:

I. Limited competition. For large construction loans ($300m+), Bank OZK comes in competition with very few other banks that are willing to that level of perceived risk. The only other bank known for commonly performing this kind of lending is Wells Fargo. Mezzanine funds are able to write similar checks, but at a much higher interest rate (SOFR + 600/700 bps), and therefore do not compete for senior financing with Bank OZK.

Note that this dynamic is more pronounced in times of market instability (e.g. Covid, today), while less so in periods of market exuberance (e.g. 2021).

II. Reliability of execution. Bank OZK screens as a professional organization that executes well.

“Bank OZK has a reputation for being quite burdensome with the information request, but extremely professional when it comes to timings and highly reliable. If you provide them with the right amount of access, and have a project that makes sense, they will get there on time and with no hiccups” – SVP of Capital Markets at Related

III. No loan syndication. Bank OZK does not syndicate the loans that it originates, which results in reduced diligence time, higher certainty of funds and lower fees.

IV. Accepting mezzanine financing junior to Bank OZK’s loan. Other banks refuse to let mezz lenders in the capital structure, with the primary argument that lower equity outlay reduces the alignment of interests between the developer and the lender. Bank OZK takes a different view, and lets Tier-1 mezz lenders (e.g. Blackstone, Brookfield) in the cap structure if the developer so desires.

The main argument for accepting mezz lending, beyond commercial considerations to win the deal, is that if the developer defaults on the equity, foreclosure of the mezz loan is a 45-90 days process, given the mezz lender does not technically foreclose on the real estate asset itself, but instead on the developers’ equity. Therefore mezz lenders can foreclose under the Uniform Commercial Code, as opposed to the judicial system. On the other hand, foreclosure by the senior lender is a foreclosure on the real estate asset, and requires a judicial process, which is a far more complex process that can take over a year.

Therefore, in a distressed scenario, a sophisticated mezz lender with strong Real Estate capabilities (e.g. Blackstone, Brookfield), will take control of the asset far sooner than Bank OZK would have been able to, and is likely to try to turn around the asset, potentially introducing additional capital and lowering the risk for Bank OZK. Also, upon foreclosure by the mezz lender, given change of control clauses, Bank OZK can further negotiate equity cures for their senior loan, which they often do:

“Upon foreclosure of a Dallas Office by the mezz lender, we negotiated a $16m loan curtailment from the mezz lender, without deteriorating our position in terms of collateral” – Q4 2020 earnings call

V. Offering non-recourse loans, that is, the developer can walk away if, upon completion, the building is worth less than the amount Bank OZK has lent. This is less of a differentiator than (IV), given other banks also offer non-recourse lending, albeit not all. The non-recourse provision always has 2 exceptions: (i) the completion guarantee, and (ii) carve-out guarantees or “bad-boy” guarantees, which basically limit the ability of the developer to diminish the value of the property in a near-bankruptcy scenario. For example, a bad-faith developer could use the long bankruptcy process to negotiate against Bank OZK and threaten to deteriorate the asset by allowing environmental contamination, not pay utilities or insurance, etc. Carve-out guarantees are designed to ensure developers act in good faith and do not have bargaining power during a long bankruptcy process.

5.4. Competitive moat and RoTE sustainability

In order to perform this type of lending, Bank OZK has built a unique organization that distinguishes it from other banks in two key areas:

I. Underwriting. Based on our conversations with industry participants, Bank OZK seems to perform a much deeper level DD than other banks, focusing on market supply/demand dynamics, potential construction pitfalls, etc. The larger average loan size allows Bank OZK to invest more diligence resources in every opportunity, but that would not be possible without the right in-house talent.

“I was very surprised when I first saw the underwriting memos from Bank OZK. They were 10-12 pages long and described the market dynamics for the asset in a lot of detail. In all other banks I have seen they are usually 3-5 pages long templates. Also, at Bank OZK the underwriting is centralized, with a single loan committee. Most other banks have decentralized underwriting for every region or business unit.” – Former VP of Commercial Lending, Bank OZK

II. Servicing & Asset Management. Bank OZK has a very proactive team following the development of each loan after origination. The bank constantly monitors whether construction is going according to budget and schedule, and only then do they approve further loan drawdowns. Also, they have the contractual right to require the developer to inject more equity, if a cost overrun or previously unidentified deficiency appears.

“Of course, large projects can go bad if the developer wastes money, plans poorly or tenant demand drops sharply. Bank OZK can mitigate poor execution by bullying the developer, which they are known for doing and currently may do quite actively, exchanging capital injections for time or concessions.” – Sam Haskell, former Research Analyst

Also, this type of lending activity requires Bank OZK to have the ability to take over foreclosed assets, which unlike in permanent lending, will be unfinished. Therefore, the bank might need to act as developer in a distressed scenario, and unlike other banks, Bank OZK does have that ability.

“Not every loan works, and you need to have the capability and the bandwidth to take an asset, finish it, manage it, and take it to market. If a sponsor is not performing, we have no reservations in operating the assets ourselves. In the past, we have operated hotels, fitness centres, built entire assets on land lots we owned, etc. It is not our preference, but if you are not willing to do that, then the borrowers can push you around if there is a problem, and we will not allow that.” – George Gleason, Bank OZK CEO

“Bank OZK has simply the best asset management team in country.” – Former SVP of Construction Lending, Bank OZK

In principle, nothing prevents other banks from replicating this model and building strong underwriting and servicing teams. However, we believe that it would not be a compelling decision for other banks because the large amount of undrawn commitments that this lending model generates requires the bank to be under-levered. As discussed in Section 2, Bank OZK, despite having almost 2x the Return on Assets as other banks, achieves a RoTE in line with industry average. The perceived level of risk from engaging in this activity, and the lack of remuneration for developing the required skillset, make an expansion towards this model unappealing for other banks.

“Almost no other banks want to do this because it is labour intensive and seems very risky. What lender making $225k, or regulator, wants to put their job on the line for a $60 million loan? Gleason takes advantage of this psychology.” – Sam Haskell, former Research Analyst

In summary, in our view:

I. Bank OZK has a strong moat and engages in a far more differentiated activity than most other banking business lines.

II. This does not lead to better RoTE than industry average due to regulatory capital constraints, but…

III. … it does provide us with a higher level of comfort that Bank OZK “deserves” to earn that RoTE and will be able to defend it in the future, which supports point (II) of our investment thesis.

Finally, note that we have not included mezzanine lenders as potential future competitors for Bank OZK. We believe that the fee structure and leverage capacity of Private Credit funds requires them to pursue higher risk opportunities at higher interest rates (above SOFR+500). Bank OZK will always be able to be more levered and have lower cost of funds than mezz lenders, and we believe the argument of overall low RoTE applies here as well. Based on our industry conversations, we have not perceived any ongoing trend around mezz lenders migrating towards the safer tranches of the capital structure.

5.5. Health of the current loan book

Bank OZK has one of the best disclosures we have seen for publicly-listed US banks, providing us with a higher-than-usual level of comfort on the health of the current loan book. Not only are Bank OZK’s lending practices sound in theory, but we also believe that, as of today, the existing loan book is in good standing.

Starting with non-performing loans, Bank OZK is not observing the upwards trajectory experienced across the industry, which has seen CRE non-performing loans increase by 74% in just 5 quarters.

Also, we draw comfort from the fact that the majority of the loan book has been originated recently, either during or after Covid. That reduces the issue of having pre-covid office exposure, and increases the likelihood that the market dynamics upon which the loans were underwritten remain relevant and have not changed.

Finally, regarding the LTV of all outstanding loans, Bank OZK publishes the chart above. Note that:

I. In conjunction with Figure 15, this graph provides a key insight: not only is the average LTV low, but also very few individual loans have high LTVs. Those that do are a consequence of a deterioration in a specific asset, they are properly provisioned for, and are addressed in detailed asset-by-asset explanations provided by management every quarter.

II. More importantly, while other banks often report LTV at origination, Bank OZK reports LTV using the latest appraised value. This is an important distinction, because an office loan originated in 2018, might have had an origination LTV of 50%, but if the value of the building has declined by 50%, it has now an LTV of 100%.

This bears the natural question around how often does Bank OZK re-appraise its loans (it is a time consuming and expensive process, and it would be unfeasible to re-apprise the 300+ outstanding RESG loans every quarter). According to our conversations with the industry, the company seems to re-appraise individual assets in case of loan extensions or modifications, if the credit quality is perceived to deteriorate and, also, as part of a periodic randomized sampling process.

As outsiders, we cannot be certain that all assets whose value has declined since origination have been recently re-appraised. However, the company discloses the following, which provides us with certain comfort:

“During the twelve months ended March 31, 2024, RESG obtained updated appraisals on 75 loans with a total commitment of $7.37 billion and appraisals on 67 newly originated loans with a total commitment of $6.99 billion, resulting in approximately 40% of RESG’s total commitments having appraisals within the last twelve months. Of the 75 loans reappraised in the last twelve months, LTVs were little changed (plus or minus 10%) for 59 loans, LTV decreased more than 10% for 2 loans and LTVs increased more than 10% for 14 loans.” – Bank OZK Mar-24 SEC Filing

6. Negative Report from Citigroup

On May 29th 2024, Citigroup downgraded Bank OZK to “Sell” due to concerns on its largest outstanding loan. The loan is $915m in headline committed value, which represents about 21% of Bank OZK’s total tangible equity. Share price declined by ~15% upon publication.

The loan is for the construction of the “Research and Development District”, in Downtown San Diego. It is a 5-building project across 8 acres of land, with ~90% of the space designated for Life Sciences and the reminder for retail. Life Sciences facilities are designed to accommodate R&D activities for biotechnology and pharmaceutical companies, which require building structures that differ significantly from traditional office (due to need for lab space). Life Science real estate commands much higher rents than office (~70% more in San Diego).

The building is being developed by IQHQ, a group founded by Alan Gold in 2020 that has raised $2.5Bn in equity and is developing 3 major Life Sciences projects: the RaDD in San Diego and two more in Boston - Cambridge. Alan Gold has a long-standing track-record in the Life Sciences sector, having served as the CEO of BioMed Realty from inception in 2004 until its sale to Blackstone in 2016.

The loan was originated in August 2022, and in its report Citigroup highlights that the RaDD is likely a struggling project, with the main arguments being:

I. No leases have yet been signed, despite RaDD having been in development for more than 4 years and being projected to come to market over the next few months.

II. RaDD is based in Downtown San Diego, which is an unproven area for Life Sciences, given most pharma companies historically have chosen other areas in San Diego (Torrey Pines, Sorrento Mesa and Sorrento Valley) to stablish their research campuses.

III. Vacancy rate in Life Sciences in San Diego is increasing significantly, and additional new construction will result in an over-supply over coming years.

Note that Citigroup’s report focuses exclusively on the supply/demand dynamics of Life Sciences in San Diego, and does not evaluate the capital structure of the project (i.e. whether potential losses will affect only the equity portion, or if they may permeate towards the debt).

An analysis of available data for the Life Sciences Real Estate market yields the following conclusions:

I. San Diego is the 3rd largest Life Sciences Market in the US, after Boston - Cambridge and San Francisco.

II. Vacancy rates have indeed increased sharply in San Diego during L18M, driven by lower VC funding for Biotech companies, as well as new construction coming to market.

III. However, this has been a widespread national occurrence, and San Diego does not screen as a city where either (i) vacancy rate is particularly high or (ii) an unusual amount of new capacity is under construction.

IV. Asking rents in San Diego have not yet declined, with 0% YoY change in 1q24.

V. The employed life sciences population in San Diego has grown at 3.5% CAGR over L11Y, with a departure from long-term trend in ’21-’22 due to unusually high Biotech VC funding, followed by a recent reversal to trend. Note that if this growth continues, a potential Real Estate oversupply of ~15% would be corrected in ~4 years.

Given the above, we agree with Citigroup’s believe that the RaDD might struggle to find tenants in the short term. However, based on Bank OZK’s additional disclosure on this loan, we believe that the risk to the debt is minimal due to the project funding structure:

I. Even if the headline commitment for the loan is $915m, only $555m have been fully funded, with the reminder earmarked for “good news funding” (i.e. tenant improvements and leasing commissions). See our discussion on Bank OZK’s lending terms in Section 5.

II. The developer has already invested ~$950m of their own equity in the project.

III. In order for Bank OZK to impair a portion of its loan, the value of the building should fall by ~75% vs the origination appraisal performed in July 2022.

Value declines of ~75% in prime real estate assets are an extremely rare occurrence and can be found almost exclusively on some very specific office buildings (see Section 4). We remind the reader that those value declines are driven by two highly unusual events: (i) a sharp decline in office demand given Covid and work-from-home trends and (ii) a rapid increase in interest rates that translated into higher capitalization rates.

The appraisal of the RaDD loan was made in July 2022, a time when WFH trends had already played out, US CPI was peaking at 9% p.a., and the Fed had already implemented three 50bps rate hikes in the preceding 3 months. We can imagine a world where the equity in this deal suffers some losses, but we believe that a decline of ~75% in the value of the asset is highly unlikely. After all, this is a high-quality asset, built by an experienced Life Sciences developer, in a Top-3 city in the country, with underlying Life Sciences employment growth, and at an enjoyable location in Downtown’s waterfront.

We therefore disagree with Citigroup’s views on the safety of this loan, and point out that, even if the funded portion of the loan was fully impaired (i.e. the recovery value of the asset was zero), that would only consume ~2 quarters of Bank OZK’s pre-tax pre-provision earnings (Figure 23). Certainly not an outcome we would cheer, but definitely not an existential risk for the bank.

7. Diversification efforts

Bank OZK ranks #1 in terms of exposure to Commercial Real Estate among all large, listed banks in the US. For the reasons covered above, we believe that in the specific case of Bank OZK this does not represent an undue risk. However, the regulator does not share our view: in the L10Y, Bank OZK has come under significant regulatory pressure to diversify away from Commercial Real Estate. George Gleason disagrees with this principle, but understands that an unfavourable relationship with the regulator is unadvisable.

Let's say, I'm in Arkansas and one of my commercial bankers from Dallas calls and says, "Hey, we've got a $10 million loan opportunity for a church in Dallas. And in order to close it, I'm going to have to do an 80% loan-to-value loan, no guarantors, a 10-year fixed rate and I can't put any covenants on, because everybody in town wants this business”

George would look at me and say, "Hey, let me ask you a question, why in the world, would I set aside capital to go put that loan on the books when I can do another $10 million loan in RESG at 55% of cost, get a 1% origination fee, at SOFR+350, with a make-whole provision for interest, and then get an exit fee" – Former Chief Credit Officer, Bank OZK

As opposed to rolling out commoditized community banking services, Bank OZK’s reaction has been to try and develop certain specific niches where they could obtain better risk-adjusted returns. To do it, they focus on acquiring highly-specialized talent within a specific vertical, and giving them freedom to grow their business inside the bank.

While in other regional banks compensation is often defined by seniority bands and other HR rubrics, Bank OZK looks exclusively at the cost-to-income ratio for the loan producers they hire, aiming to stay at ~20%. For example, a banker able to develop a $50m loan book with a 4% net interest margin would be generating $2m of Net Interest income for the bank and could be compensated with up to $400k in gross compensation.

The largest niche Bank OZK has created is the RV and Marine lending business, which currently accounts for 11% of all loans, and which they have grown out of a small M&A target in 2016. The key principles of operation of this division are:

I. Loans are originated indirectly through a network of ~1,400 dealers nationwide, which offer their customers a Bank OZK loan to finance the purchase of a boat, campervan or motorhome.

II. Customers must have a very high credit score (average of ~790 FICO).

III. Customers must have experience in having owned at least two similar vehicles in the past, so as to ensure that they understand and are able to withstand the financial commitment it represents.

IV. Loans are full recourse to the owners. The purchased vehicle acts as collateral, but given the depreciating nature of these assets and high LTVs, losses are likely to occur in case of default.

Credit Quality in the RV and Marine division has historically been outstanding, and no deterioration is being experienced in the current cycle. On the other hand, given the fixed-rate nature of this product, yields are increasing slower than SOFR. The portfolio reprices as old loans mature and are replaced by new loans originated in a higher interest rate environment.

Bank OZK is currently also ramping up efforts in its Corporate division. This division currently accounts for ~6% of all assets, with the majority allocated to Asset Backed Loans. The key principles governing Bank OZK’s ABLs are:

I. They are credit lines backed by existing account receivables and inventory.

II. Loan commitments average $30-300m, and around ~40-50% are usually drawn at any given time.

III. Loans are variable rate, with pricing 200-300bps above SOFR.

IV. The advance rate is 85-90% of eligible receivables and 85% of the net liquidation value of eligible inventory. Only current receivables (i.e. not aging) and easily disposable inventory are accepted as collateral.

ABLs are considered a safe form of lending, given losses occur only in the highly unlikely scenario where a large corporate enters bankruptcy AND the receivables or inventories that have been lent against are insufficient collateral. As a result, there is significant competition within this segment and differentiated RoTEs are unlikely. We remind the reader, however, that our investment thesis revolves around Bank OZK achieving RoTEs in line with the banking industry, and there is no apparent reason why growth in this segment would invalidate our assumption.

Finally, the Community Banking division, which accounts for 18% of all loans, consists mostly of generalist small and middle-market business loans originated in the states where Bank OZK has physical branches, and as part of their comprehensive deposit strategy. Included in this division are also smaller niche lines of national reach, such as poultry financing, homebuilder loans, business aviation or affordable housing.

Going forward, Bank OZK believes that growth in the business lines above will result in RESG becoming ~50% of total business, from 65% today. Should it occur, RoTE is unlikely to fundamentally change, but we believe that a valuation re-rating would become a more likely source of upside, given widespread market concerns around Bank OZK’s current concentration in Commercial Real Estate. Concerns that, as discussed, we do not share and that we believe provide an attractive entry opportunity.

8. Risks

The main risks that we believe an investment in Bank OZK entails are:

I. CEO retirement

II. Credit risk

III. Sensitivity to interest rates

IV. Run-on-the-bank risk

V. Regulatory Risk

As for CEO Retirement, we refer the reader to Section 3.

Regarding Credit Risk, a lot has been written in this report about the soundness of the lending practices and the health of the current loan book (Sections 5, 6 and 7). As a final remark, the analysis below on the loss absorption capacity shows that Bank OZK would be able to absorb losses accounting for ~10% of all loans outstanding, which equates to 22x their current level of non-performing-assets, or 6x the peak level of charge-offs experienced during the GFC.

Regarding Interest Rate Sensitivity, Bank OZK does not have a held-to-maturity security portfolio (i.e. carried at cost), accounting for all their securities as available-for-sale (i.e. carried at current fair value). Also, 75% of their earning assets are variable-rate, which paired with a sticky retail deposit base, has led to a faster repricing of the assets than the liabilities over the last 2 years, and hence expanding Net Interest Margins. To avoid the opposite effect in case of a decline in interest rates, interest rate floors are being introduced on all newly originated loans. As of 1q24, 56% of the loans had a floor at SOFR=225bps or above (i.e. minimum interest of ~5.75% assuming 350 bps spread).

The main risk regarding interest rates, in our view, is that a decline in rates would lead to a higher level of repayments in outstanding construction loans, given developers would be more likely to find attractive permanent loan offers with which to refinance Bank OZK’s financings. That would be a short-term stream of exit and make-whole fees for Bank OZK, but could put pressure on the RESG outstanding balance and result in a temporary deleveraging of the bank until new originations could replenish the repaid loans, as happened during 2021 (Figure 8).

We believe this tension between origination and repayment rates is inherent to the Bank OZK’s business model, given the short-term nature of the loans and the developers’ natural incentive to refinance in good times. As such, Bank OZK is likely to periodically experience periods of deleveraging, and this is the main reason why we forecast forward through-the-cycle RoTE in the range 13-15% as opposed to the current ~17%.

As for risk of a bank run, we note that sound financial institutions rarely experience them, although exceptions may occur (e.g. small bank run experienced by Western Alliance in 1q23).

We note, too, that bank runs are not driven by analysis but by collective perception, which would put Bank OZK at an increased risk: after all, the description “regional bank with an outsized exposure to commercial real estate” would be unlikely to calm wary depositors if a bank run started to unfold.

Conscious of this risk, the bank has pursued a deposit strategy focused on maximizing the percentage of deposits that are insured (i.e. those deposits that are under $250k and therefore insured by the FDIC). In the 2023 Regional Banking crisis, insured deposits across the industry proved highly sticky, given the American layman seems to understand that the FDIC (i.e. “the government”) will protect his funds if his bank fails.

Out of the Top 50 banks in the US, Bank OZK is #3 in share of insured deposits, having 81% of their deposits either insured or collateralized, and featuring a very low $44k average customer deposit, pointing to the truly retail nature of their deposit base. The proof of the quality of the deposit base can be found on the behaviour following SVB collapse, a time when Bank OZK managed to substantially increase core deposits while most Regional Banks did not.

Finally, Regulatory Risk is a concern, and can arise from two main sources:

I. As discussed in Section 7, the regulator has historically pressured Bank OZK into diversifying away from RESG. Until now, Bank OZK has been able to continue to hold ~65% of their loan book in CRE, but, should regulatory pressure increase, the bank would likely need to diversify faster into other business lines.

II. New regulatory frameworks might increase the capital requirements for all banks, as has happened with Basel II and Basel III. If that were to occur, it is unclear if Bank OZK would be able to translate the additional capital requirements into higher pricing, and therefore, RoTE might decline.

This is a risk that, although not existential, might reduce the long-term returns from our investment by a few percentual points. At 6.8x 2024 Earnings, however, we feel adequately compensated for this risk.

DISCLAIMER

THE INFORMATION CONTAINED ON THIS REPORT IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

Red Beryl is not a regulated institution.

Hi,

Loved the article back in Jul'24 :) So far, it has been a bumpy ride. I was wondering what your take was on this one?

https://therealdeal.com/chicago/2025/03/29/bank-ozk-to-seize-chunk-of-sterling-bays-lincoln-yards/

Their credit track record is spotless, but this one comes soon after IQHQ RaDD San Diego - in addition, they are modifying and extending many loans. How do you monitor their credit quality to avoid Taleb's Turkey?

Great article, thanks!

How would you rate the rest of the management team? (CFO, CLO, etc.) At first glance, they don't seem to have the same tenure and seniority as Gleason.